Launch Your Own Capital Market Infrastructure

in 30 Days!

Hydra is the ultimate FinTech foundation platform...

Begin Your Journey

About Hydra

Open Digital capital market Infrastructure

Hydra is a commercial of the shelf (COTS) platform-as-a-service (PaaS) that allows both incumbent financial institutions and FinTech to develop, run, and manage investment and trading products and services without the complexity and cost of building critical infrastructure first.

Hydra does the heavy lifting, so, you don’t have to. The result is faster time-to-market, huge cost savings and a micro-focus on your actual revenue drivers like product development and customer acquisition.

Features

Extensible/Customizable

Commercial-of-the-shelf (COTS)

Cloud-based (public or private)

Service oriented architecture (SOA) based

Integrated online billing & payments system

Built on the Microsoft.NET Technology Stack

Capabilities

Are you a financial services provider (Fintech, commercial or digital bank) with a large customer base? Deploy Hydra so that you can offer multi-asset, multi-currency securities trading to your customers through one or more licensed broker/dealers and get paid for each trade.

Hydra offers a lightweight, scalable data aggregation and vending platform with integrated online pay-per-use billing and multiple delivery methods (Web Widgets, CSV and API). Hydra is able to access market data feeds (for re-distribution) using global standard protocols such as FIX, JSON/REST and Websockets. Hydra data vending platform is perfect for securities exchanges that need to deliver market data directly to a retail consumer base (App developers, FinTech etc.).

Hydra’s Artificial Intelligence gives you the ability to quickly deploy a risk questionnaire to match investors’ risk profiles to your own tested and trusted investment strategies. Hydra ships with an out-of-the-box robo-advisor that you can build on. Put your robo-advisor directly in the hands of your investors via Hydra’s web terminal or use Hydra API to seamlessly integrate your robo-advisor into financial systems such as OMS/EMS, portfolio & wealth management applications.

Hydra Analytics delivers a modern workspace designed to reduce research and analysis busywork. Hydra Analytics offers pre-built & pre-tested guru analytic models (Greenblatt’s Magic Formula, Piotroski’s F-Score, O’Shaughnessy Value Composite, Altman’s Z-Score and more) plus the tools you need to create, test and deploy your own. Hydra Analytic models can be delivered directly to customers through the Hydra web terminal or seamlessly integrated via API into other financial systems such as OMS/EMS & wealth management systems.

Introductory Brokerage (IB)

Are you a financial services provider (Fintech, commercial or digital bank) with a large customer base? Deploy Hydra so that you can offer multi-asset, multi-currency securities trading to your customers through one or more licensed broker/dealers and get paid for each trade.

View Use Case

Market Info & Data Re-distribution

Hydra offers a lightweight, scalable data aggregation and vending platform with integrated online pay-per-use billing and multiple delivery methods (Web Widgets, CSV and API).

Hydra is able to access market data feeds (for re-distribution) using global standard protocols such as FIX, JSON/REST and Websockets. Hydra data vending platform is perfect for securities exchanges that need to deliver market data directly to a retail consumer base (App developers, FinTech etc.).

View Use Case

Robo-Advisory

Hydra’s Artificial Intelligence gives you the ability to quickly deploy a risk questionnaire to match investors’ risk profiles to your own tested and trusted investment strategies. Hydra ships with an out-of-the-box robo-advisor that you can build on.

Put your robo-advisor directly in the hands of your investors via Hydra’s web terminal or use Hydra API to seamlessly integrate your robo-advisor into financial systems such as OMS/EMS, portfolio & wealth management applications.

View Use Case

Market Analytics

Hydra Analytics delivers a modern workspace designed to reduce research and analysis busy-work. Hydra Analytics offers pre-built & pre-tested guru analytic models (Greenblatt’s Magic Formula, Piotroski’s F-Score, O’Shaughnessy Value Composite, Altman’s Z-Score and more) plus the tools you need to create, test and deploy your own.

Hydra Analytic models can be delivered directly to customers through the Hydra web terminal or seamlessly integrated via API into other financial systems such as OMS/EMS & wealth management systems.

View Use Case

Innovation & Incubation Sandbox

Are you a capital market innovation hub, Fintech incubator, accelerator or regulator? Hydra makes the perfect choice for quickly creating and managing a sandbox that allows you to evaluate product ideas for functionality, commercial viability or regulatory compliance.

Hydra leverages all of its capabilities and suite of applications to deliver a fully functional Sandbox out-of-the-box. Plus with Hydra’s flexible online billing and payments system, it’s quite possible to use the same infrastructure to run both a Sandbox and a Production platform to support your start-ups.

View Use Case

Multi-Exchange & Multi-Brokerage Order-Routing System

Hydra’s order-routing engine offers infrastructure operators the flexibility to run either a closed network/linkage of broker/dealers across multiple securities exchanges or an open marketplace that connects investors and traders directly to any asset classes offered by participating brokers and exchanges.

In either scenario, Hydra API seamlessly integrates brokers OEMS to activate straight-through-processed (STP) order execution and management..

View Use Case

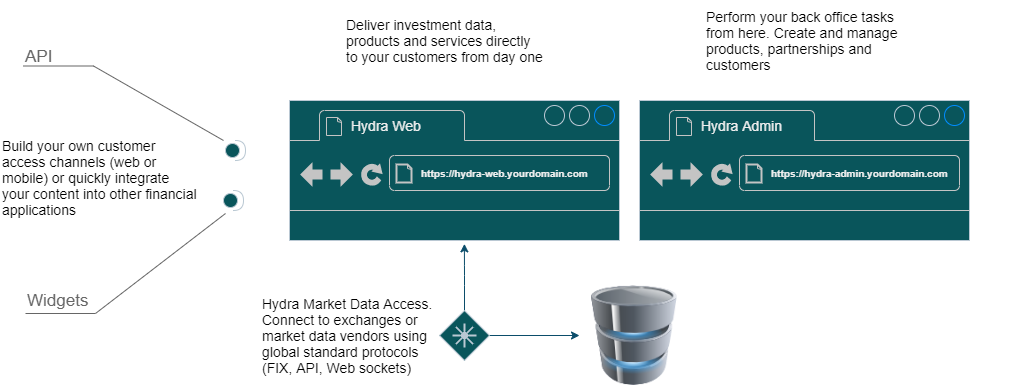

Architecture

Application Suite

Developer Access Channels

Build your own customer access channels (mobile, web etc.) or integrate other financial applications... Learn More

Customer Web Terminal

HCWT is an out-of-the-box collection of secure Web Forms and Widgets so that you can deliver your pro... Learn More

Market Data Access

Multi-protocol market data access layer. Get data from your preferred wholesale aggregators or parti...

Learn More

Admin Web Terminal

Do your back office work from here. Simple graphical user interfaces for creating and managing your...

Learn More

Case Studies - The Investor Hangout

The Investor Hangout (The Hangout) project is the maiden FinTech deployment of Hydra.

The Idea

The Hangout team set out to build an online capital investment hub. A natural habitat for a new generation of investors, traders and analysts. Their main goal was to create a fully digitized investment and trading experience online. Learn, plan, execute and monitor all from one single market place, all online.

The Problem

Online trading (OMS/EMS) was an important component of the Hangout project. However, even though the team had planned on adopting the introductory brokerage model, they also wanted the system to be broker agnostic. Investors and traders should be free to choose their brokers.

The Solution

They deployed Hydra and the result is a vibrant fully digitized investment marketplace with an online trading system powered by 5+ SECNG licensed brokers. Anyone who visits the Hangout, can learn about investing, follow the markets, start a new brokerage account, engage a robo-advisor, buy and sell securities plus monitor the resulting portfolio all from a web browser.

Licensing

Lease

Annual software license lease and Service Level Agreements (SLA)

Own Binaries

Non-Redistributable software license forever ownership without source code

Own Source Code

Non-Redistributable software license plus source code forever ownership